5 Reasons Why You Can't Beat Bitcoin

Why fighting the inevitable will become the most expensive strategy

Every fiat currency in history has gone to zero.

All of them.

Gold has been money for 5,000 years.

Fiat currencies last an average of 35 years.

Bitcoin?

It's been 16 years and the governments that tried to kill it are now fighting to own it.

There will only ever be 21 million Bitcoin.

8 billion people in the world.

The math is simple.

The implications are everything most people miss.

We've reached that inflection point where fighting Bitcoin costs more than joining it.

Like standing against the tide – you can do it for a while, but eventually you get swept away.

Here's why Bitcoin has moved beyond speculation into inevitability:

1. The Government Threat No Longer Exists

For fifteen years, Bitcoin faced one existential question:

Would governments kill it before it could grow?

The answer is definitive now.

They won't.

The United States – the same government that once could have banned Bitcoin – implemented a Presidential Executive Order positioning Bitcoin as a national strategic asset. They're developing a U.S. Strategic Bitcoin Reserve and are finding budget-neutral strategies to actively buy Bitcoin.

The transformation is complete:

Daily ETF inflows: $134.1 million average, with maximum daily inflows reaching $1.12 billion

Corporate treasuries: Over $54 billion in Bitcoin holdings

Companies like MicroStrategy transformed into de facto Bitcoin funds with competitors being launched like Twenty One (backed by Cantor Fitzgerald, the company of Howard Lutnick, the United States Secretary of Commerce), as well as Trump’s own media company

This is strategic embrace that eliminates what was consistently cited as the number one risk factor preventing institutional adoption.

And now the global arms race begins

Following the U.S. strategic pivot, other nations are racing to develop their own Bitcoin strategies. Each nation that accumulates Bitcoin increases pressure on others to follow suit.

The optimal strategy becomes getting Bitcoin before competitors do – regardless of initial opinion.

What was once Bitcoin's greatest vulnerability transformed into its strongest tailwind through competitive governmental dynamics.

2. The Supply Story Most Investors Ignore

Most people obsess over demand. But Bitcoin's supply is what makes it compelling.

The supply curve changes overnight every four years. That's why price will continue to rise.

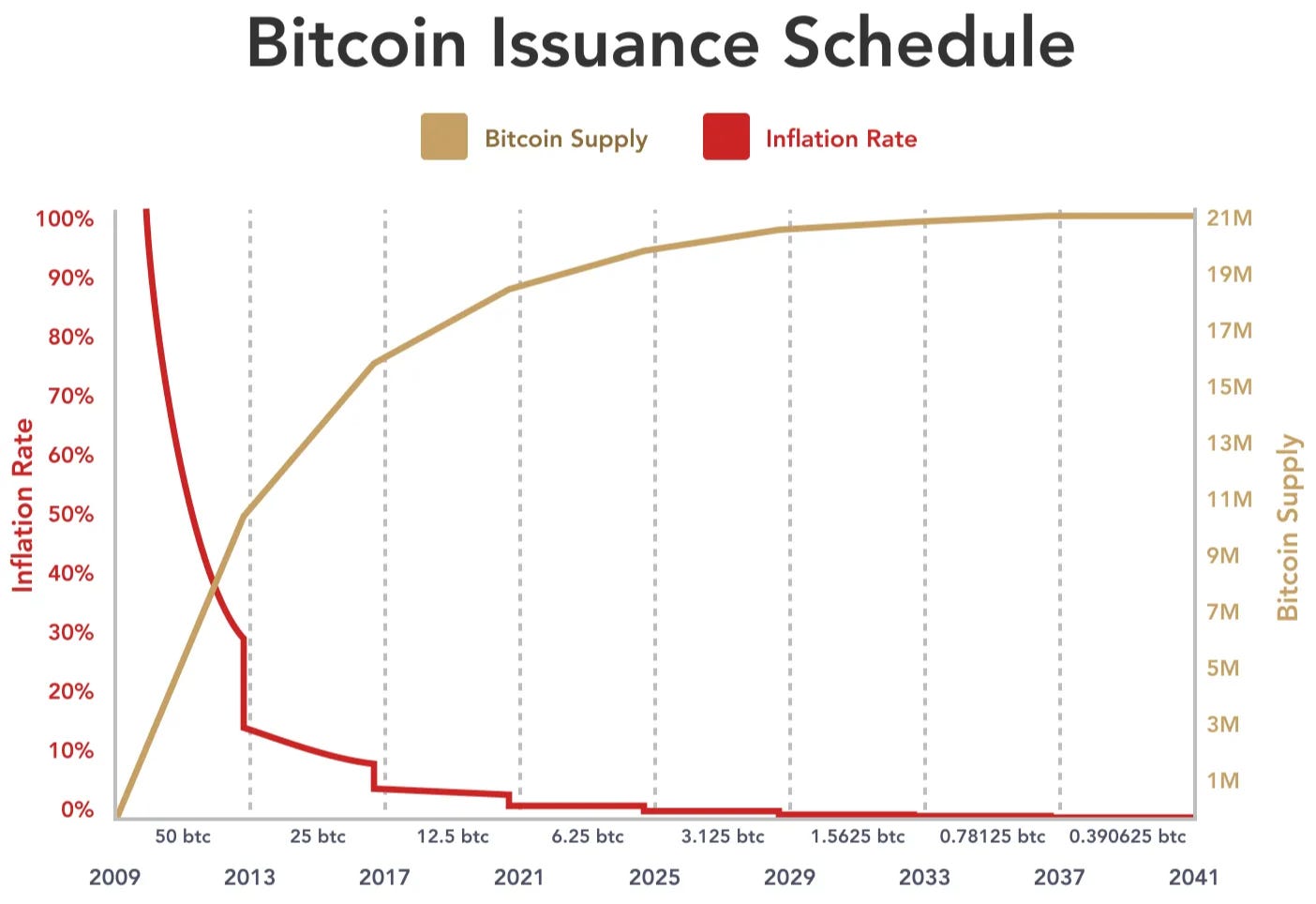

The Halving Effect: Every four years, new Bitcoin creation gets cut in half. The 2024 halving reduced issuance from 6.25 to 3.125 BTC per block. Bitcoin's annual inflation rate now sits below 2% – trending toward zero.

The Production Cost Floor: As Bitcoin's price rises, mining becomes more profitable. More miners join the network. Hash rate increases. Energy costs rise. This creates a rising production cost floor for Bitcoin's price.

The economic principle is straightforward:

The price of any commodity tends to gravitate toward its cost of production.

As adoption drives Bitcoin's price up, production costs follow, creating new support levels.

Fiat Money Printing Accelerates: Meanwhile, central banks create money at will. Consider this stark reality: 40-80% of all dollars in existence were created in just the past few years.

Bitcoin's issuance?

Mathematically fixed, creation decreasing every four years.

3. The Portfolio Problem Bitcoin Solves

Traditional 60/40 portfolios (60% stocks, 40% bonds) failed spectacularly during COVID. Stocks and bonds crashed together, with correlations hitting 42%.

Diversification became meaningless.

Bitcoin provides actual diversification when you need it most.

Research demonstrates that adding just 1-5% Bitcoin allocation significantly improves risk-adjusted returns through genuine low correlation with traditional assets. During crisis periods when everything else moves together, Bitcoin often moves independently.

The Global Liquidity Connection: Bitcoin behaves as a macro asset driven by global liquidity conditions. In 2022-2023, roughly $2.2 trillion was drained from global markets through tightening policies. Despite this massive liquidity removal, Bitcoin rose 500%.

Now the cycle reverses:

Europe cutting interest rates

China and Japan in easing mode

U.S. Fed expected to end quantitative tightening

When central banks print money, Bitcoin historically benefits most. Gold often leads this cycle, with Bitcoin following and outperforming.

As the DXY (Dollar Index) falls, both gold and Bitcoin typically rise – but Bitcoin amplifies the move.

4. The Ultimate Freedom Asset

Bitcoin solved the oldest problem in finance:

How to own an asset no government can debase, no bank can freeze, and no border can stop.

For Global Citizens:

Portugal: Tax-free after 365 days for residents

Singapore: No capital gains tax for non-professional trading

UAE: Zero capital gains tax

True Portability: Bitcoin is digital, more portable than gold, and you can't fake it. You can carry $10 million in your pocket across any border. Try doing that with real estate or stocks.

Censorship Resistance: Properly self-custodied Bitcoin cannot be frozen, seized, or inflated away. For global citizens navigating multiple jurisdictions and potential political instability, this represents true financial sovereignty.

The Spending Strategy: During bull markets, you can spend from Bitcoin holdings using debit cards while the value appreciates faster than you spend. It's like DCA in reverse – you spend the gains, not the principal. Your Bitcoin pays for your life while continuing to grow.

5. Smart Money Already Chose Sides

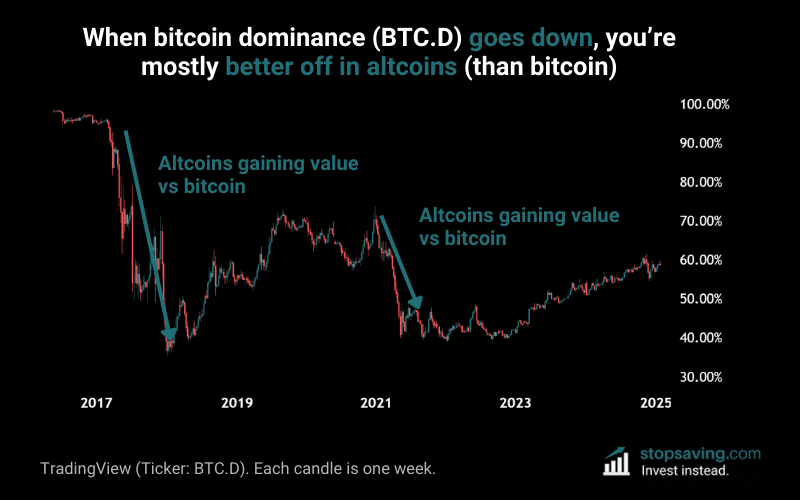

Bitcoin vs. altcoins isn't about returns – it's about reliability when you need it most.

Experienced investors who've navigated multiple cycles often become Bitcoin-focused for practical reasons:

Altcoins are typically more centralized

They face higher regulatory risk

They're more manipulable and illiquid

They can crash 80-90% on a single news event

Bitcoin dominance has gradually been trending up

Every cycle, people get wrecked chasing altcoins. They make money fast and lose it faster. For serious wealth preservation and global mobility, Bitcoin's track record and decentralization make it the clear choice.

The Institutions Agree: BlackRock, Fidelity, and sovereign wealth funds don't speculate. They allocate based on inevitable trends. When institutions that manage trillions start buying an asset with a fixed 21 million supply, the math becomes clear.

Bitcoin has passed the point of being stoppable. The danger was always that governments would kill Bitcoin before it grew. That risk is gone.

The Price Projections Reflect New Math

Expert analysis suggests Bitcoin could reach:

$200,000 by end of 2025

$1,000,000 by 2029

Some experts like Fundstrat’s Tom Lee even suggest higher targets…

As Lee points out with the stat from Bitwise:

“95% of all Bitcoin has been mined, but 95% of the world doesn’t own Bitcoin.”

So these aren't just speculative targets. They reflect fundamental supply-demand imbalances:

Fixed supply schedule meeting exponentially growing institutional demand

Regulatory transformation eliminating the primary adoption barrier

Network effects from parallel institutional and corporate adoption

Bitcoin outperformed every major traditional asset in 2024 "by a very wide margin." The best-performing asset class just removed its biggest risk factor.

I'm hosting a webinar with André Dragosch, European Head of Research at Bitwise:

Bitcoin in 2035: How Much Will Bitcoin Be Worth in a Decade?

What we'll cover:

1. Bitcoin’s performance vs. traditional assets

2. The role of institutional adoption and macro trends & what it means for price

3. How to build true long-term conviction (beyond hype & fear).

4. Scenarios for Bitcoin’s value in 2035 - from conservative to moonshot

Whether you're a crypto investor, fund manager, or just curious about Bitcoin's role in the future economy, this webinar will give you valuable insights.

Save your seat using the link below – spots limited.

This isn’t being uploaded to YouTube. To get the replay, you will need to register.

Why Fighting This Became Expensive

The transformation of regulatory risk into institutional embrace represents a structural shift in Bitcoin's investment profile. What was once priced with significant regulatory risk discount now reflects institutional validation and governmental strategic interest.

For those building comprehensive freedom strategies through citizenship diversification, tax optimization, and asset protection, Bitcoin now offers:

Monetary sovereignty independent of any single jurisdiction

Portfolio optimization through genuine diversification

Liquidity that transcends borders and regulatory regimes

Long-term wealth preservation through mathematically enforced scarcity

Implementation for Global Citizens

Allocation Strategy: Financial advisors now implement 1-5% Bitcoin allocations as standard optimization. This provides meaningful upside exposure while limiting downside risk.

The key insight: You don't need to bet everything on Bitcoin. You need to avoid having zero position while institutional FOMO builds.

Self-Custody Fundamentals: For sovereignty-minded individuals, self-custody becomes essential. Hardware wallets and multi-signature setups ensure you maintain control regardless of jurisdiction or political climate.

Not your keys, not your Bitcoin. This isn't paranoia – it's practical insurance for global citizens who understand that any government can freeze any account.

But if you can't do it:

ETFs can be a valid alternative. For high amount of money, consider to diversify ETFs per jurisdiction to hedge risks.

Integration with Citizenship Strategies: Bitcoin complements multi-jurisdiction strategies perfectly. It provides liquidity bridging between tax regimes and residency requirements while offering protection against currency devaluation or capital controls.

Think of Bitcoin as the ultimate backup currency for your citizenship portfolio.

The New Reality

Governments that tried to ban Bitcoin are now accumulating it.

Institutions that called it a bubble are now allocating to it.

Central banks that said it would never be money are now studying how to compete with it.

The question isn't whether Bitcoin will integrate into the global financial system. The question is how quickly will you position yourself before this transformation becomes consensus?

Bitcoin represents the most elegant solution to monetary sovereignty in the digital age.

The regulatory threat that made it speculative has been eliminated.

What remains is the most liquid, portable, and censorship-resistant asset in human history.

Early allocation ensures your seat before everyone else realizes the game has changed.

For global citizens, Bitcoin isn't optional – it's inevitable.

P.S. For those specifically interested in a pathway to EU citizenship via Portugal's Golden Visa, we at Bitizenship have created an innovative solution combining EU residency with Bitcoin – allowing you to invest the €500K requirement while acquiring exposure to Bitcoin.

With the end of Malta’s golden passport, Portugal’s Golden Visa is now the fastest and most secure path to EU citizenship available.

To learn more about securing your EU future while participating in the future of finance, schedule a free consultation call.

I’d love to know:

What has your Bitcoin journey been and how are you adopting it into your freedom stack?

Reply to this email/comment below and let me know your thoughts I would love to hear your take.

And if you enjoyed reading this post, feel free to click the ❤️ button and restack so more people can discover it on Substack! 🙏

Great post Alessandro, well done